Joint Whitepaper between Singapore EDB and Wright Partners:

The Corporate Venture Valley of Death (Summary)

Disclaimer

This article is a condensed version of the white paper: “The Corporate Venture Valley of Death”, jointly written by EDB and Wright Partners. Wright Partners is a corporate venture studio that partners with EDB under the Corporate Venture Launchpad programme to help companies design, launch, and scale new ventures. You can read the full white paper here

Crossing the Corporate Venture Valley of Death

What is the white paper and this summary about?

A field guide for executives who want their corporate ventures to survive the fragile early stretch when cash is tight, proof is thin, and politics get loud. It explains why corporate ventures fall into the Valley, then lays out a playbook on how to make the jump to the other side.

What is the Venture Valley of Death?

All ventures, whether corporate, or in-the-wild, that fails before it proves a sustainable path is a victim of the valley. These are the three most common causes:

Funding gap: seed money runs out before the venture earns a larger round.

Cash-burn gap: spending outpaces revenue, the startup is default-dead, not default-alive.

Research to commercial gap: grants or internal R&D end before market traction begins.

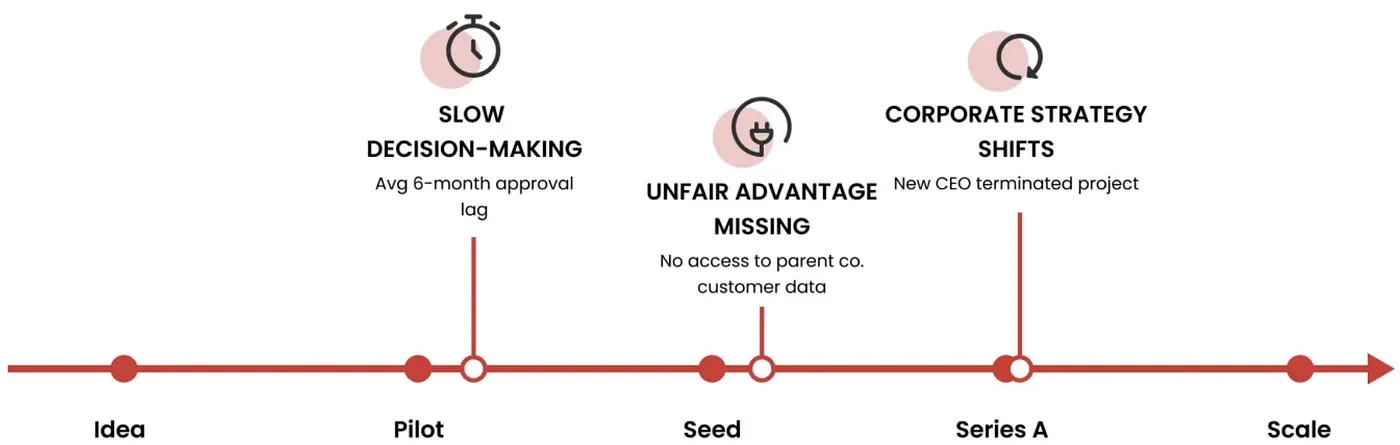

Why corporate ventures face extra headwinds

58% of business leaders ranked venture building as a a top priority. Yet, most corporate ventures never make it to revenue. That’s unsurprising as corporate ventures inherit all the usual startup risks, with three additional structural handicaps:

Slow decision cycles

Approvals for budget, hiring, legal etc. can take weeks which bleed momentum, drain talent, and close market windows. Speed is non-negotiable. if a venture can’t run fast, the corporate shouldn’t build it at all.

Unrealised unfair advantage

Ventures are promised distribution, data, brand, and shared services. Many receive little beyond introductions. Some run into internal competition as business units fear cannibalisation. If the venture cannot leverage the parent’s advantages, the corporate parent probably should not do it.

Mid-course strategy shifts

Leadership changes and budget resets strands a venture with no sponsor, regardless of its KPIs. Smart builders plan lifeboats early. For corporate ventures, Innovation without sponsorship is just theatre.

Universal root causes to fix first

Three failure modes show up across independent and corporate ventures:

Flawed venture design & validation

Building ventures that sound clever but do not solve real market-needs is the top cause for startup failure (42%). It’s alarmingly common for corporate teams (or their hired consultants) to declare a venture “validated” after a few polite “customer interviews” or a cursory market survey, only to find out after investing millions that customers won’t pay for it.

Wrong founding team and capital structure

Founder selection and incentives make or break ventures. Too often, founders are chosen for availability, not grit or skill, and without real upside through equity or performance bonuses. That makes them less likely to push through setbacks and harder for external investors to trust the team’s commitment.

Insufficient adaptability

Markets shift, inputs change, pilots stall. Teams that cannot pivot decisively burn through runway and die on schedule.

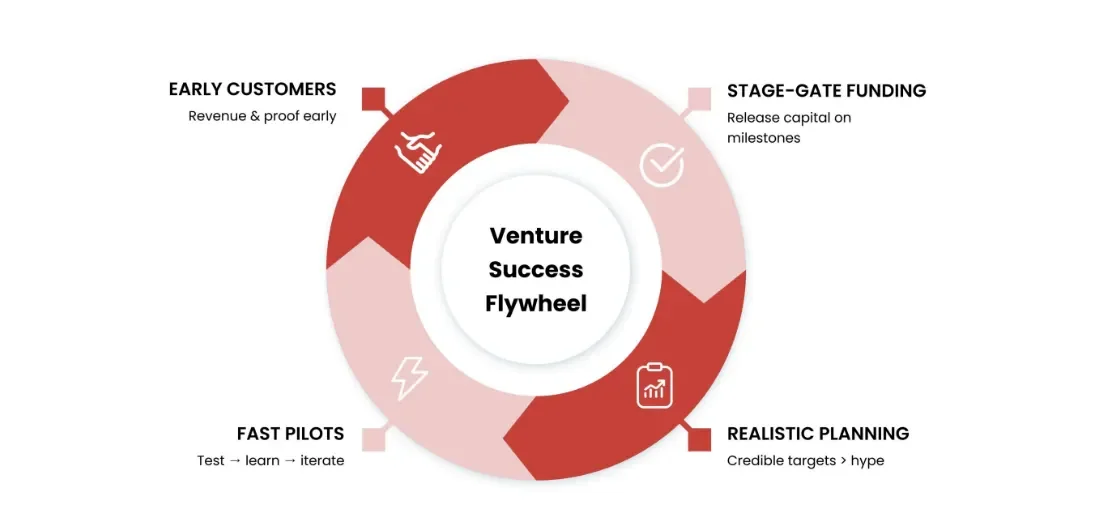

The playbook to shorten the Valley of Death

1) Run a real Design Phase, not a box-ticking “validation” exercise

Treat the first 4 to 6 months as a pressure test, not a victory lap. Answer four questions with evidence, not slides:

• What painful problem are we solving, and do customers truly care?

• How much is it worth when solved, quantified in dollars or time?

• How many customers have this pain and will actually pay?

• Can we deliver value for less than it costs, with enough margin to make the business viable?

Teams must sell during this phase. Priced pre-orders, LOIs or paid pilots beat any research deck. Kill ideas that fail these tests.

2) Prioritise early revenue

Design minimal solutions customers will pay for, then iterate. Even small revenues proves value and signals viability to boards and investors. Waiting a year to charge is how ventures drift into the Valley.

3) Stage-gate funding with milestones and kill switches

Release capital in tranches tied to objective stage-gates (eg. paying customers, a working prototype etc.). If the gate is missed, pause or stop.

4) Align incentives and make the structure investable

Treat the venture lead like a founder, not a project manager. Give the core team real upside which makes the venture externally investable. Be willing to give up full control in exchange for survival and growth.

5) Build for speed and focus

Create lightweight governance that allows week-scale decisions. Use corporate shared services for payroll, legal and IT so the team can focus on product and customers.

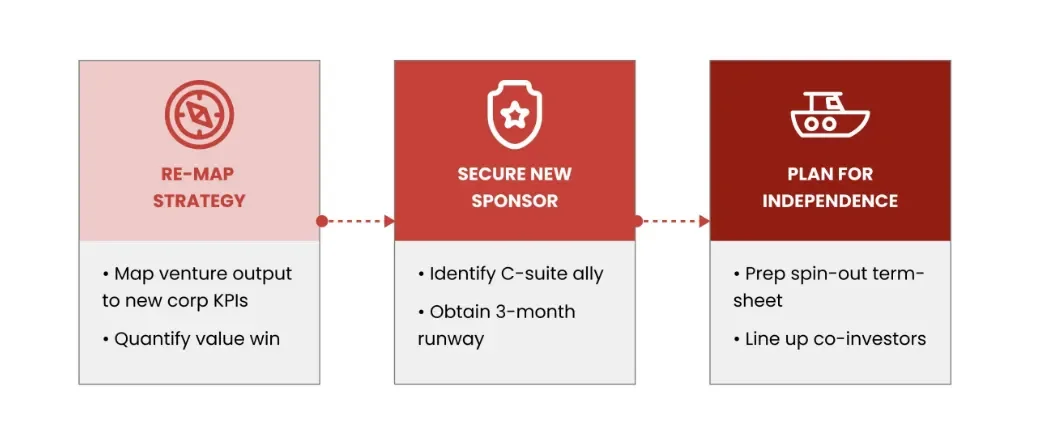

How Corporate Ventures can better survive their parent’s strategy shifts

Hope for stability, plan for turbulence. The paper proposes four survival moves that can be prepared in advance:

• Re-test alignment of the venture within 30 days of strategic shifts,

• Renew executive sponsorships early and have more than one point of failure

• Formalise internal support for access to data, distribution and services

• Line up outside capital or a spin-out path for the venture

Executive venture checklist you can act on this quarter

Lock the Design Phase scope, timeline and exit criteria. Fund only to the next gate.

Demand at least two real buying commitments from customers before full build.

Document the venture’s access to data, distribution and shared services.

Define decision rights that allow sub-two-week approvals for spend, hires and vendor contracts.

Put founder-level incentives in place for the lead team.

Identify a back-up sponsor and outline a spin-out option with legal and finance.